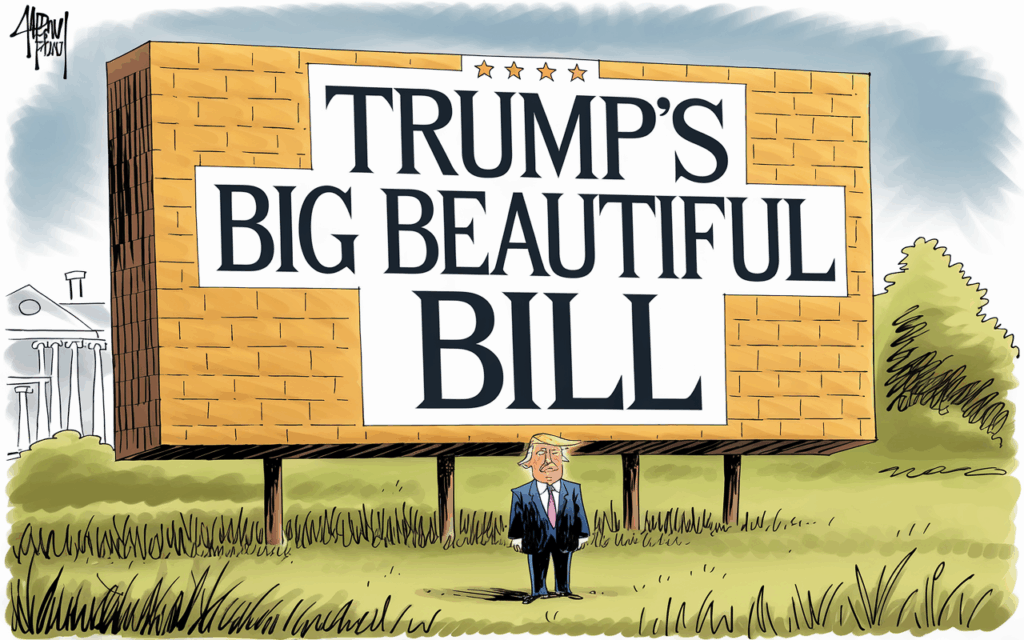

The Seven Ugliest Provisions in Trump’s ‘Big Beautiful Bill’ 😡💰

In the recent political arena, the unveiling of Donald Trump's "Big Beautiful Bill" has sent shockwaves through communities across America. While it flaunts a glamorous title, the contents reveal a deep-rooted commitment to fiscal inequity. As the bill progresses to the Senate, a closer inspection of its ugly provisions uncovers a reverse-Robin Hood nightmare – stealing from the poor to give to the rich. 😢📉

1) Undermining the Rule of Law ⚖️

One of the most alarming aspects of this bill is a provision that blocks funding to enforce contempt of court orders. This could enable unchecked actions by the executive branch, essentially rendering judicial decisions powerless. Legal experts warn that this undermines democracy and opens doors for lawlessness.

2) Rewarding Rich Homeowners 🏡💸

The SALT (state and local tax) deduction has been quadrupled in this bill, predominantly benefiting affluent homeowners in blue states. While middle-class families bear the brunt of increased tax burdens, high-income earners in states like New Jersey and California reap significant rewards. This glaring disparity raises questions about fairness and responsibility in tax legislation.

3) A Boondoggle for Private Schools 📚💼

In an astonishing move, the tax act provides a backdoor subsidy for private school vouchers. Wealthy donors who contribute to nonprofits that facilitate private K-12 schooling can now count every dollar as a tax credit. This not only diverts funds away from public education but also encourages a flight from public schools.

4) Leave No Heir Behind 👶🏰

The bill also appears poised to benefit the heirs of billionaires by indexing the estate tax exemption to inflation. This could allow affluent families to pass down wealth without facing significant taxation—a move that critics argue will deepen the chasm of wealth inequality in the United States.

5) Shortchanging Kids of Immigrants 🚫👶

Among its many provisions, the Big Beautiful Bill introduces restrictions on the child tax credit, limiting it solely to citizens. This exclusion threatens nearly two million children in mixed-status households, effectively penalizing families who contribute to our society and economy.

6) No Insurance for You! 🚫🏥

A highly contentious change is the implementation of work requirements for Medicaid eligibility. This requirement could strip health insurance from an estimated 10 million people, forcing individuals to navigate complex bureaucracies while battling poverty simultaneously.

7) Work for Your Supper 🍞👷

Expanding work requirements for SNAP (food assistance) recipients, particularly for parents with young children, could result in 2.7 million households losing essential food benefits. This relentless push for labor in exchange for help only serves to deepen the struggles of those in need.

In conclusion, while the title “Big Beautiful Bill” may suggest prosperity, the realities within paint a daunting picture of neglect for the vulnerable and unprecedented favor for the wealthy. It’s crucial for Americans to remain informed and engaged, as the implications of this bill could shape the future landscape of our economy and social fabric. Let’s champion policies that uplift everyone, not just a select few! 🙌✨

Stay tuned for updates as this bill progresses, and let your voice be heard. 📢

#TaxPolicy #PoliticalDiscourse #BigBeautifulBill #FightForJustice

More Stories

Exciting News: The Summer I Turned Pretty is Becoming a Movie

Reflecting on Robert Redford’s Legacy of Integrity and Artistry

Sara Rivers Appeals Dismissal of $60 Million Lawsuit Against Sean Combs: A Fight for Justice in the Entertainment Industry