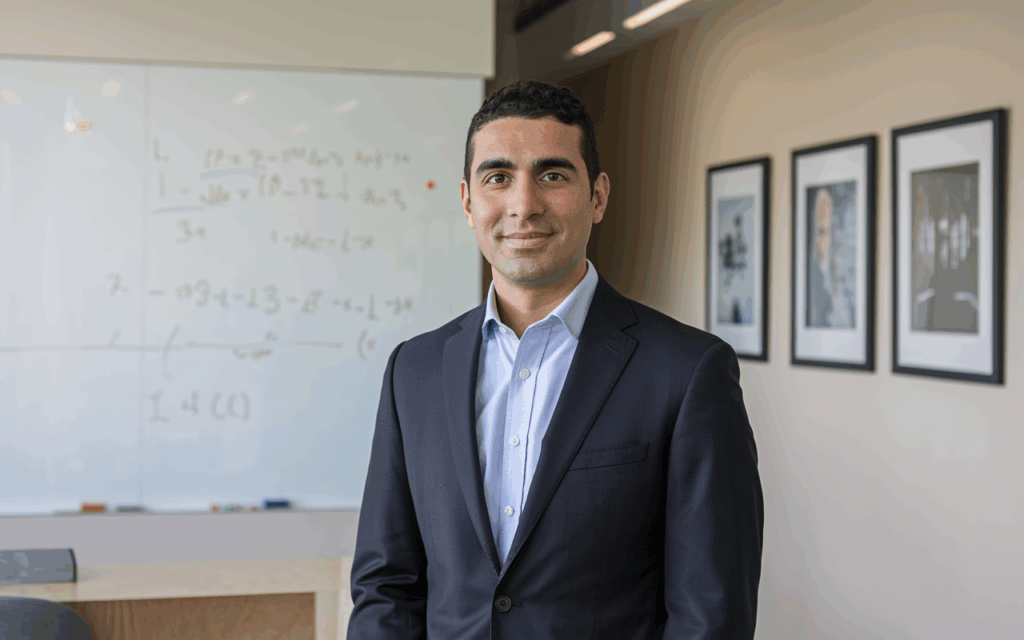

Revolutionizing Remittances: How Khalid Ashmawy’s Munify is Changing the Game for Egyptians Abroad 🌍💰

In today's fast-paced world, sending money across borders shouldn't have to be a painfully slow and expensive process. However, many expatriates—especially from emerging markets—still face hefty fees and lengthy wait times when transferring funds back home. This is where Munify, a fresh neobank founded by Khalid Ashmawy, comes into play! 🚀

The Inspiration Behind Munify

Khalid’s journey from the streets of Cairo to the technology hubs of Europe and the U.S. has equipped him with unique insights, especially regarding the struggles faced by individuals needing to remit funds. After experiencing high fees and delays while transferring money during his studies, Khalid realized the existing banking system didn't cater effectively to the Egyptian diaspora. This personal pain point ignited his passion to create a solution. 🌟

Having previously held significant roles at Microsoft and Uber, Khalid had the technical expertise and entrepreneurial spirit to pivot towards fintech. With Munify, he aims to provide Egyptians abroad—a group that largely includes those in the U.S., U.K., and the Gulf region—a platform that allows for instant and cost-effective money transfers home. 🏦

What Makes Munify Stand Out?

-

Direct Banking Connections: Munify operates by building its own rails, directly connecting banking systems across countries, which enables quicker transactions and lower fees.

-

Dual Consumer and Business Model: Not only does Munify serve individuals wanting to send money home, but it also provides businesses, freelancers, and remote workers in the Middle East with access to U.S. banking services.

-

Innovation Over Imitation: While many neobanks lean on AI technologies, Munify’s success stems from its focus on solving a pragmatic and urgent issue—it’s like a breath of fresh air amidst the AI hype! 🌬️

Why Now?

Remittances to Egypt constitute a staggering $30 billion annually, ranking amongst the world's highest. Traditional players like Western Union and MoneyGram still dominate, but the scope for innovation in this field is vast. As fintech continues to disrupt traditional banking, Munify stands ready to take the reins in the burgeoning digital banking landscape. 📈

The startup recently concluded a successful fundraising round of $3 million from Y Combinator and several regional investors, marking a significant step forward in its journey. Y Combinator, known for backing startups that tackle sizable financial infrastructure problems, recognized Munify's potential to make a difference for migrants, affirming the accelerator’s focus on real-world issues. 🌏✨

Looking Ahead

Exciting plans lie ahead for Munify! With ambitions to expand to other Middle Eastern countries and beyond, Khalid Ashmawy and his team are on a mission to stitch together banking infrastructures across the region. This venture could very well change the landscape of remittances for millions of Egyptians and other diaspora communities looking for efficient, cost-effective banking solutions. 👍

In conclusion, Munify exemplifies how personal experiences can inspire groundbreaking solutions. As Khalid Ashmawy puts it best: "If you’re solving a big and urgent problem, that’s what really matters." It's a reminder of the incredible potential we have when we channel our challenges into innovative projects that can help others.

👉 Ready to learn more about Munify? Check them out here!

Join the Conversation!

What do you think about the future of neobanks and their impact on remittances? Share your thoughts below! 💬

#Fintech #Remittances #Startups #Neobank #Munify #KhalidAshmawy

More Stories

Meta’s AR Ambitions and AI Safety: Insights from the Equity Podcast

Insight Partners Data Breach: A Wake-Up Call for Cybersecurity Awareness

Lovable’s Ascendancy: Anton Osika at TechCrunch Disrupt 2025