🛰️ A Troubled SPAC’s Ambitious $400M Acquisition of iRocket: What Does It Mean for the Future? 🚀

In a surprising turn of events, iRocket, a small launch startup, is set to go public through a deal valued at $400 million with the BPGC Acquisition Corp—a special purpose acquisition company (SPAC) backed by former Commerce Secretary Wilbur Ross. This partnership comes at a time when the SPAC has significantly dwindled in cash reserves, making one wonder: is this a savvy move or a reckless gamble? 🤔

📉 The Cash Conundrum

The BPGC Acquisition Corp raised $345 million in its IPO back in March 2021 but has returned much of that to shareholders after failing to secure a suitable acquisition target by September 2024. They currently hold just $1.6 million in trust, which raises serious questions about how they plan to fund this ambitious acquisition. 🤑

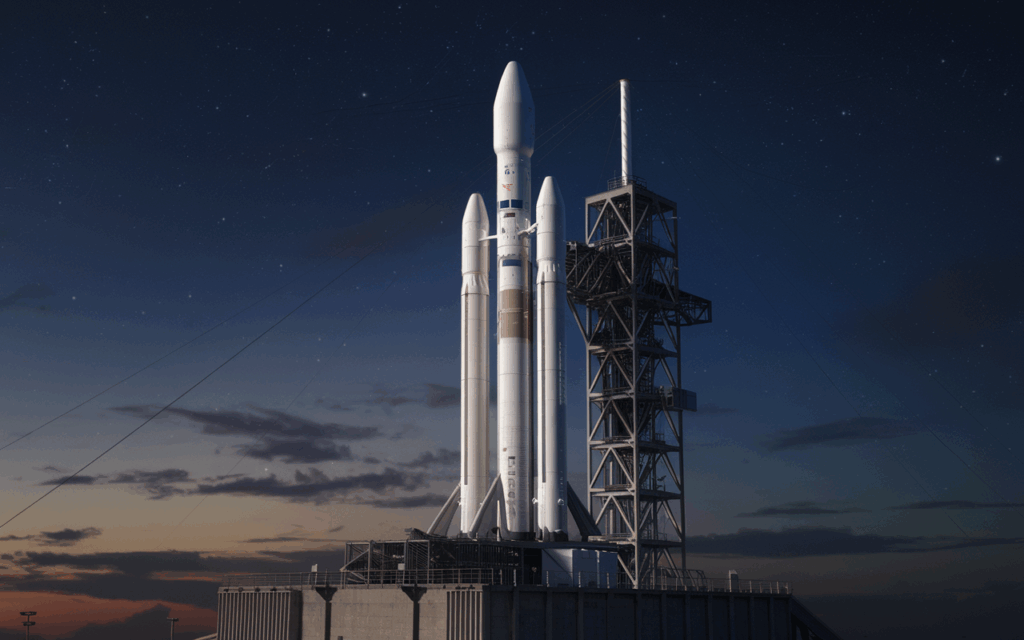

🌌 About iRocket

Founded in 2018, iRocket aims to bring revolutionary launch technologies to the market. It’s a catchy proposition, but one has to wonder whether the startup has what it takes to compete in an already crowded industry. The firm has yet to complete a single test flight of its Shockwave launch vehicle, putting it at a disadvantage against better-capitalized competitors like Stoke Space and Firefly.

💡 iRocket's Promising Yet Challenging Vision

iRocket purports that its vehicle will offer a payload capacity ranging between 300 kg to 1,500 kg, along with features like full reusability and rapid refurbishment. However, proving these capabilities is no small task, and many industry observers remain skeptical. Will they be able to rise to the occasion? 🤷♂️

🚫 A Checkered History

It's worth noting that the very SPAC initiating this deal has a rocky past. Previously known as Ross Acquisition Corp II, it attempted to merge with Aprinoia Therapeutics but abandoned the deal eight months later. With a history of struggles, whether this SPAC can successfully finalize the acquisition of iRocket is yet to be seen. 🔍

🤝 What’s Next?

For this deal to succeed, iRocket and BPGC will likely need to secure substantial private investment through a PIPE (private investment in public equity) round. The existing shareholders of iRocket might find it hard to cash in on their equity unless new funding is introduced.

🎯 Final Thoughts

In conclusion, the headlines may make this acquisition sound promising, but the reality is filled with uncertainty. With cash reserves straining and competitors lurking, both iRocket and the SPAC have their work cut out for them. Only time will tell if they can turn this ambitious plan into a successful reality. 🌟

Do you think this merger will pay off, or is it destined to be a major blunder? Share your thoughts! 💬

#SpaceTech | #InvestmentTrends

Stay tuned for more updates as this story develops! 🌠

More Stories

Meta’s AR Ambitions and AI Safety: Insights from the Equity Podcast

Insight Partners Data Breach: A Wake-Up Call for Cybersecurity Awareness

Lovable’s Ascendancy: Anton Osika at TechCrunch Disrupt 2025